Gold in an Investment Portfolio Why It’s a Valuable Asset

Investing is an essential part of building wealth and securing financial stability for the future. When constructing an investment portfolio, there are many different types of assets to consider, such as stocks, bonds, real estate, and commodities. One asset that has stood the test of time and proven to be a valuable addition to any investment portfolio is gold.

Gold has been valued and coveted by humans for thousands of years due to its rarity and scarcity. It has been used as a form of currency, a store of value, and a safe haven during times of economic uncertainty. In recent years, gold has become increasingly popular among investors as a means of diversifying their portfolios and protecting against market volatility. In this article, we will explore why gold is a valuable asset to include in an investment portfolio.

1. The Historical Performance of Gold

###- A Hedge Against Inflation

One of the primary reasons investors turn to gold is its ability to act as a hedge against inflation. Inflation is the general increase in the price of goods and services over time, resulting in the decrease of the purchasing power of a currency. When inflation rises, the value of traditional investments, such as stocks and bonds, may decrease. However, gold has historically maintained its value during times of high inflation. This is because the supply of gold is limited, and it cannot be easily manipulated or inflated like paper currency.

###- A Diversifier of Risk

Another reason gold is a valuable asset to include in an investment portfolio is its ability to diversify risk. Diversification is a strategy that involves investing in a variety of assets to minimize the impact of market fluctuations on overall portfolio performance. Gold is considered a low-correlation asset, meaning it tends to move independently from other investments. Therefore, adding gold to a portfolio can help mitigate risk and reduce volatility.

###- A Safe Haven During Market Turmoil

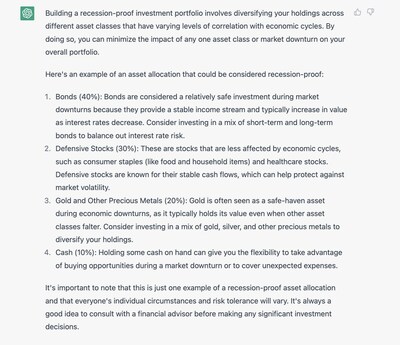

Gold is also known as a “safe haven” asset because it tends to perform well during times of economic and political uncertainty. When the stock market experiences a downturn, investors often flock to gold as a safe place to store their wealth. This is due to its historical stability and ability to retain value during market turmoil. During the 2008 financial crisis, for example, when the stock market took a major hit, gold prices soared as investors sought a safe haven.

2. The Diversification Benefits of Gold

###- Balancing Your Portfolio

The main purpose of diversification is to reduce risk and increase returns. By adding gold to your investment portfolio, you are introducing a new asset class that can balance out the performance of other investments. For instance, if the stock market is performing poorly, the price of gold may rise, providing a potential offset to losses in your stock investments. This balancing effect can help stabilize overall portfolio performance.

###- Protection Against Correlation Risks

As mentioned earlier, gold is a low-correlation asset, meaning its performance does not move in tandem with other assets. This is especially beneficial during times of high market volatility, where traditional investments such as stocks and bonds tend to move in the same direction. By including gold in your portfolio, you can protect against correlation risks and have a more diversified and resilient portfolio.

###- Potential for Higher Returns

While gold is traditionally viewed as a defensive asset, it also has the potential to provide higher returns. In recent years, gold prices have experienced significant growth, outperforming many other assets. Its scarcity, coupled with increasing global demand, has contributed to this growth. As such, adding gold to your investment portfolio not only offers diversification benefits but also has the potential for capital appreciation.

3. Different Ways to Invest in Gold

###- Physical Gold

The most traditional way to invest in gold is to purchase physical gold, such as bars or coins. Physical gold provides investors with a tangible asset that they can physically hold and store. However, this method of investing comes with additional costs for storage and insurance. It also requires a significant upfront investment, making it less accessible for some investors.

###- Gold ETFs

Investing in gold through an Exchange-Traded Fund (ETF) is a popular option for those looking for a more cost-effective and convenient way to add gold to their portfolio. A gold ETF is a fund that holds physical gold or tracks the price of gold. Through a gold ETF, investors can gain exposure to the precious metal without having to hold physical gold themselves. This makes it a more accessible option for retail investors.

###- Gold Mutual Funds

Similar to gold ETFs, gold mutual funds are professionally managed investment funds that invest in a portfolio of gold-related assets. These assets may include stocks of companies involved in gold mining and exploration or gold bullion. Gold mutual funds offer investors diversification and professional management at a lower cost compared to purchasing individual stocks or physical gold.

4. Common Misconceptions About Gold

###- Gold is Not a Reliable Source of Income

One misconception about gold is that it can provide a steady stream of income. Unlike dividend-paying stocks or rental properties, gold does not generate any cash flow. Therefore, it should not be viewed as a source of income but rather as a means of preserving wealth and diversifying risk in an investment portfolio.

###- Owning Physical Gold is Risk-Free

While physical gold is considered a safe haven asset, it still carries risks. Storing large quantities of physical gold at home can pose security risks, and the market for buying and selling physical gold can be volatile. Therefore, investors must take precautions and do their research when purchasing and storing physical gold.

###- Gold Prices Always Rise During Economic Uncertainty

While gold often performs well during times of economic turmoil, it is not immune to market trends. Its price is influenced by various factors, such as supply and demand, interest rates, and global political events. Therefore, it is essential to look at the bigger picture and not rely solely on gold as a safe haven during uncertain times.

5. Frequently Asked Questions About Gold in an Investment Portfolio

###- Is gold a good investment for beginners?

Gold can be a suitable investment for beginners, especially those looking to diversify their portfolio. However, it is important to conduct proper research and seek professional advice before investing to understand the risks and potential rewards.

###- How much of my portfolio should be invested in gold?

The amount of gold to include in a portfolio depends on an individual’s risk tolerance and investment goals. It is recommended to have around 10-15% of your portfolio allocated to gold to achieve adequate diversification.

###- Can I lose money by investing in gold?

As with any investment, there is always a risk of losing money when investing in gold. Its price can fluctuate, and if sold at the wrong time, investors may see a loss. However, gold has historically maintained its value over time, making it a relatively stable asset to hold in a long-term investment portfolio.

###- What is the best way to invest in gold?

The best way to invest in gold depends on an individual’s financial situation and investment goals. Some options include purchasing physical gold, investing in gold ETFs or mutual funds, or buying shares of gold mining companies. It is essential to consider the associated costs and risks when deciding on the best way to invest in gold.

###- Is now a good time to invest in gold?

It is challenging to predict whether now is the right time to invest in gold. Its price can be affected by various factors, making it difficult to time the market. The best approach is to consider gold as a long-term investment and make informed decisions based on your financial situation and risk tolerance.

Conclusion: Gold Adds Value to an Investment Portfolio

In conclusion, gold is a valuable asset to add to an investment portfolio due to its historical performance, diversification benefits, and potential for higher returns. It acts as a hedge against inflation, balances out portfolio risk, and provides stability during market turmoil. While there are various ways to invest in gold, it is important to conduct proper research and seek professional advice to determine the best approach for your specific financial goals. With that said, by including gold in your investment portfolio, you can potentially increase its resilience and achieve long-term financial success.