Invested Student Loans Refinance Maximizing Your Education Investment

Student loans are a necessary evil for many individuals pursuing higher education. While they provide the financial means to attend college, they also come with a hefty price tag in the form of interest rates and monthly payments. However, with the option of refinancing student loans, borrowers have the opportunity to improve their financial situation and potentially save thousands of dollars in the long run. In this article, we will explore the benefits and considerations of investing in student loan refinancing and how it can help students make the most out of their education investment.

1. Understanding Student Loan Refinancing

What is Student Loan Refinancing?

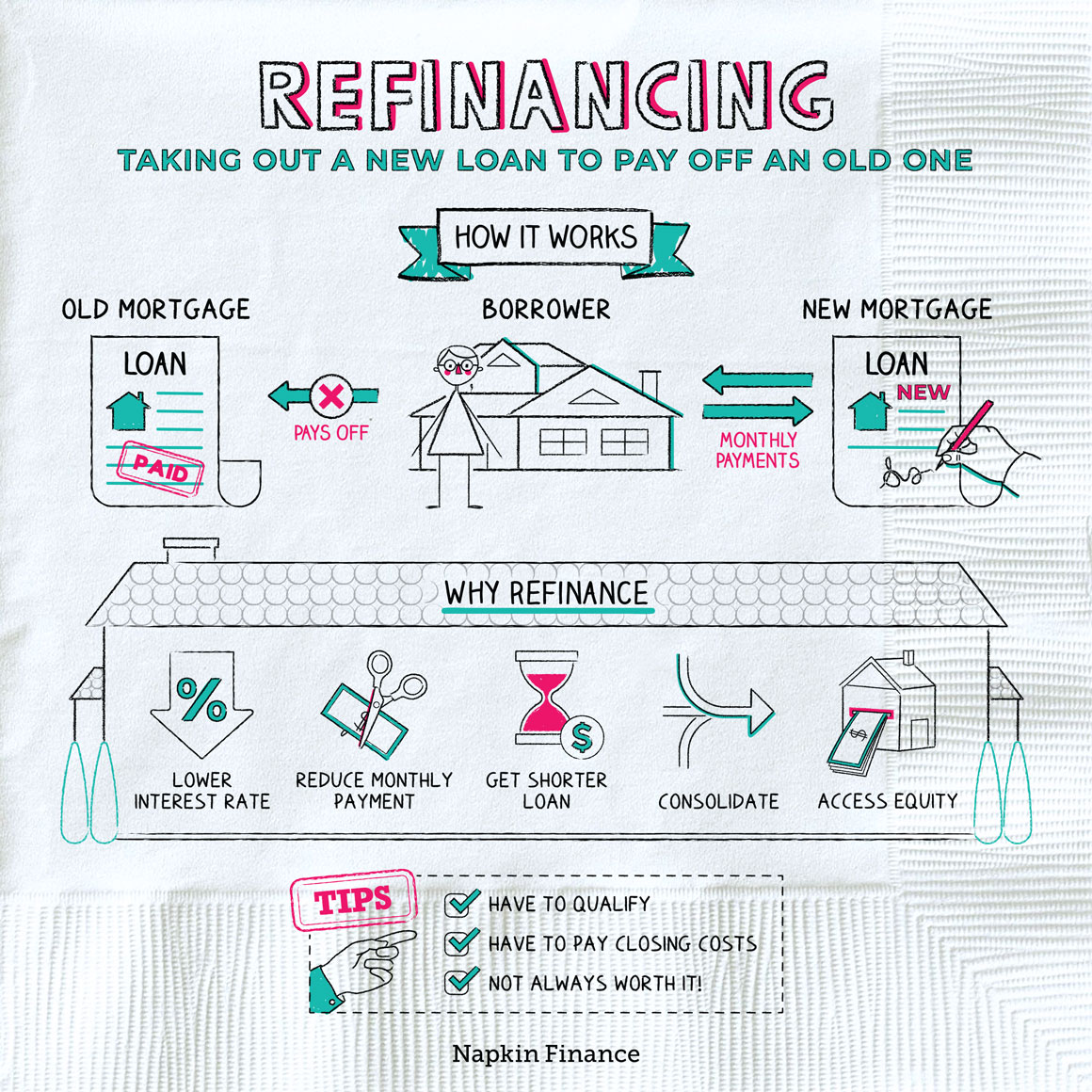

Student loan refinancing is the process of taking out a new loan from a private lender to pay off existing student loans. This new loan typically comes with a lower interest rate and different repayment terms, providing borrowers with the opportunity to save money on interest and potentially lower their monthly payments.

How Does Student Loan Refinancing Work?

To refinance student loans, borrowers must apply for a new loan with a private lender and go through the approval process. If approved, the new loan will be used to pay off the existing student loans, and the borrower will make payments on the new loan according to the agreed-upon terms.

Benefits of Student Loan Refinancing

- Lower interest rates: With good credit and income, borrowers may be able to secure a lower interest rate on their refinanced loan compared to their original student loans.

- Consolidation of multiple loans: Refinancing allows borrowers to combine multiple student loans into one, simplifying the repayment process.

- Flexible repayment options: Private lenders often offer a variety of repayment plans, including fixed or variable interest rates, to suit individual needs.

- Potential for lower monthly payments: By securing a lower interest rate and spreading out payments over a longer term, borrowers may be able to lower their monthly payments.

- Potential to save thousands of dollars in the long run: With a lower interest rate and potentially lower monthly payments, borrowers can save significant amounts of money over the life of the loan.

2. Factors to Consider Before Refinancing Student Loans

Eligibility Requirements

Before considering refinancing, borrowers should check the eligibility requirements of different private lenders. These may include credit score, income, and debt-to-income ratio.

Current Interest Rates

It’s important to compare current interest rates offered by private lenders with the interest rates on existing student loans. If current rates are significantly lower, it may be worth refinancing to save money on interest.

Potential Loss of Federal Loan Benefits

When refinancing federal student loans, borrowers will lose the benefits associated with those loans, such as income-driven repayment plans and forgiveness programs. It’s crucial to weigh the potential savings from refinancing against the loss of these benefits.

3. When is the Right Time to Refinance Student Loans?

After Graduation

For recent graduates, refinancing student loans can be a smart move as they have likely improved their credit scores and may have secure employment, making them more eligible for better interest rates.

When Interest Rates Drop

If interest rates drop significantly, it may be a good time to consider refinancing and potentially save money on interest.

If Financial Situation Improves

As borrowers’ financial situation improves, they may become eligible for lower interest rates and favorable terms, making refinancing a viable option.

4. The Process of Refinancing Student Loans

1. Check Eligibility

Before applying for refinancing, borrowers should check their credit score, income, and debt-to-income ratio to ensure they meet the eligibility requirements of private lenders.

2. Shop Around for Lenders

It’s essential to compare offers from multiple lenders to find the best interest rates and terms. Consider factors such as customer service, repayment options, and any fees associated with the loan.

3. Gather Necessary Documents

To apply for refinancing, borrowers will need to provide documents such as pay stubs, tax returns, and proof of graduation.

4. Apply for Refinancing

Once all necessary documents are gathered, borrowers can submit an application for refinancing. The lender will review the application and make a decision on whether to approve or deny the loan.

5. Pay Off Existing Loans

If approved, the new loan will be used to pay off the existing student loans, and borrowers will begin making payments on the refinanced loan according to the agreed-upon terms.

5. FAQs About Student Loan Refinancing

Can I refinance both federal and private student loans?

Yes, borrowers can refinance both federal and private student loans with a private lender. However, it’s important to consider the potential loss of federal loan benefits before refinancing federal loans.

Will refinancing affect my credit score?

Refinancing may initially cause a slight dip in credit score due to the hard inquiry from the lender. However, consistently making on-time payments can help improve credit over time.

Are there any fees associated with refinancing?

Some lenders may charge origination fees or prepayment penalties, so it’s essential to read the terms carefully before refinancing.

Can I refinance more than once?

Yes, borrowers can refinance more than once if they find better terms or interest rates in the future.

What happens if I can’t make payments on the refinanced loan?

If borrowers are struggling to make payments on the refinanced loan, they should contact their lender immediately to discuss alternative options. Some lenders offer forbearance or deferment options for financial hardship situations.

Conclusion:

Investing in student loan refinancing can be a wise decision for borrowers looking to save money on interest and simplify their repayment process. Before making the decision to refinance, it’s essential to carefully consider eligibility requirements, current interest rates, and potential loss of federal loan benefits. With proper research and understanding, borrowers can make an informed decision that maximizes their education investment and sets them up for financial success in the future.