The Benefits of Investing in the Stock Market Online

Investing in the stock market has long been considered one of the most effective ways to build wealth. However, with the rise of technology, investing in the stock market has become more accessible and convenient than ever before. With just a few clicks, anyone can now invest in the stock market online. In this article, we will delve into the benefits of investing in the stock market through online platforms.

The Convenience of Investing in the Stock Market Online

Time Flexibility and Accessibility

One of the major advantages of investing in the stock market online is the convenience it offers. With traditional methods, investors would have to go through a broker or make time to physically visit a stock exchange to buy or sell stocks. This process can be time-consuming and requires a lot of effort. However, with online investment platforms, investors have the flexibility to manage their investments at any time and from anywhere in the world. This means that busy individuals can still invest in the stock market without having to disrupt their daily routines.

Lower Transaction Costs

Another benefit of investing in the stock market online is the lower transaction costs. Traditional methods of investing often involve high brokerage fees and other hidden charges. On the other hand, online investment platforms have significantly lower fees as they do not have the same overhead costs as traditional brokers. This makes it more cost-effective for investors, especially those who are just starting out with smaller investments.

Access to Detailed Information and Analysis

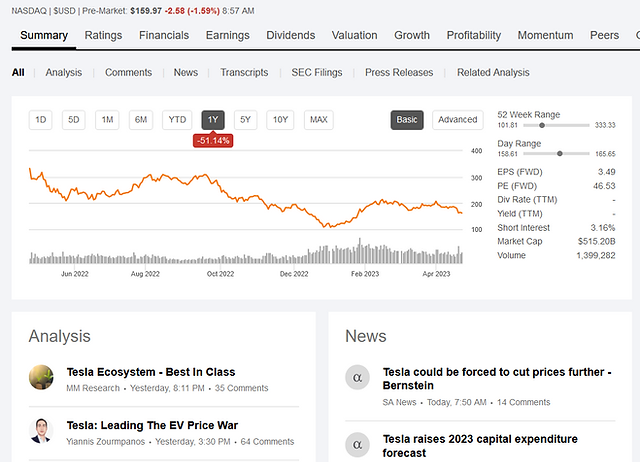

Online investment platforms also offer access to detailed information and analysis on various stocks. These platforms provide investors with real-time data, news, and charts to help them make informed decisions about their investments. Additionally, many online platforms also offer tools and resources for technical and fundamental analysis, making it easier for investors to understand and analyze the performance of their chosen stocks.

Diversification and Risk Management

Diversification of Investments

Another advantage of investing in the stock market online is the option to diversify investments. Diversification is an essential risk management strategy that involves spreading out investments across different assets to reduce the overall risk. With online investment platforms, investors have access to a wide range of stocks, including both domestic and international markets. This allows them to diversify their portfolio and reduce the risk of losing all their investments in one type of stock.

Automated Portfolio Management

Online investment platforms also offer automated portfolio management services. This means that investors can set their investment goals and risk tolerance levels, and the platform will automatically select and manage a diversified portfolio for them. This takes the burden off investors, who may not have the time or expertise to actively manage their investments. Additionally, these automated services often come with lower management fees than traditional portfolio managers.

Risk Management Tools

Many online investment platforms also provide risk management tools to help investors track and manage their investments. These tools can help investors set stop-loss orders, which automatically sell a stock if it reaches a certain price, limiting potential losses. They can also set up alerts for any significant changes in the market, allowing them to make quick decisions to minimize potential risks.

The Flexibility and Freedom of Online Investment

Fractional Shares

One of the most significant advantages of investing in the stock market online is the ability to purchase fractional shares. Traditional methods require investors to buy whole shares, which can be expensive, especially for high-priced stocks. However, with online investment platforms, investors can purchase a fraction of a share, making it more affordable for them to invest in a diverse range of stocks.

No Geographical Restrictions

Investing in the stock market online also offers the freedom to invest in companies from around the world. Traditional methods often limit investors to their domestic market, making it challenging to access international opportunities. With online investment platforms, investors can easily invest in foreign companies, providing them with more investment options and potentially higher returns.

Control over Investment Decisions

Investing in the stock market online also gives investors more control over their investment decisions. They are not dependent on a broker’s advice or recommendations, allowing them to make their own decisions based on their research and analysis. This gives investors a sense of empowerment and ownership over their investments, making it a more satisfying and fulfilling experience.

Frequently Asked Questions

What is the minimum amount required to start investing in the stock market online?

The minimum amount required to start investing in the stock market online varies depending on the platform. Some platforms allow investors to start with as little as $10, while others may require a minimum of $500 or more.

Is it safe to invest in the stock market online?

Yes, investing in the stock market online is generally safe. However, it is essential to do thorough research and choose a reputable and regulated platform. It is also advisable to diversify investments and manage risks effectively.

How much experience do I need to start investing in the stock market online?

You do not need any prior experience to start investing in the stock market online. Many platforms offer educational resources and tools to help beginners learn about investing and make informed decisions.

Can I withdraw my investments at any time?

Yes, most online investment platforms allow investors to withdraw their investments at any time. However, there may be certain restrictions or fees associated with early withdrawals, so it is important to check with the specific platform.

Are there tax implications for investing in the stock market online?

Yes, like any other investment, there may be tax implications for investing in the stock market online. It is essential to consult a tax professional for guidance on how to report and pay taxes on your investments.

Conclusion

Investing in the stock market online offers significant benefits, including convenience, lower costs, access to information and analysis, risk management, flexibility, and freedom. However, it is important to remember that with any investment, there are risks involved. It is crucial to do thorough research, diversify investments, and manage risks effectively to make the most out of your online stock market investments. With the right strategy and mindset, investing in the stock market online can be a highly rewarding and profitable venture.